Term Life

Provide financial stability for your family.

Simple and affordable plans with no medical exams and cash-back options.

We work with top insurance carriers.

Get term life insurance your way.

Apply Now

Get the coverage you need instantly with no medical exam.*

Live Chat With an

Agent

Our trusted agent are here to answer any questions you have along the way.

Schedule a

Consultation

A licensed agent can help you find a plan, either over the phone or through video conference.

Benefits of Term

Life Insurance

Easy Application

No medical exam required, apply in minutes and receive your policy instantly.* 100% online.

Affordable

Policies can cost less than $18/month.

Flexible

Choose your term and the coverage that’s right for you.

Protection

Coverage up to $1 million. A policy for everyone.

Rewards

Earn rewards and discounts for living a healthy lifestyle.*

LIFE INSURANCE

Term vs. Permanent: Which Type of Life Insurance Do I Need?

Meet Angela D.

At 26, Angela has a brand new job, is a full time grad student and has a fiancé. She wants an affordable life insurance policy that is easy to obtain to accommodate her hectic schedule.

$50,000

20 years

$13/month

Meet John L.

At 33, John and his partner just welcomed their second child. He wants an affordable life insurance policy that will protect his growing family.

$500,000

15 years

$34/month

Meet Althea G.

Meet Althea G.At 40, Althea, mother of two, recently purchased a brand new home with her partner. She wants coverage that will match her needs and ensure that her loved ones are protected.

$1,000,000

20 years

$105/month

Life Insurance for

Everyone

Having a pre-existing condition like diabetes should not prevent you from keeping your loved ones protected. Quility offers term life insurance without a medical exam, and your licensed agent will ensure we find the coverage to match your individual needs.

Want more options?

We get it.

Quility Level Term offers:

Flexible payment options

100% online

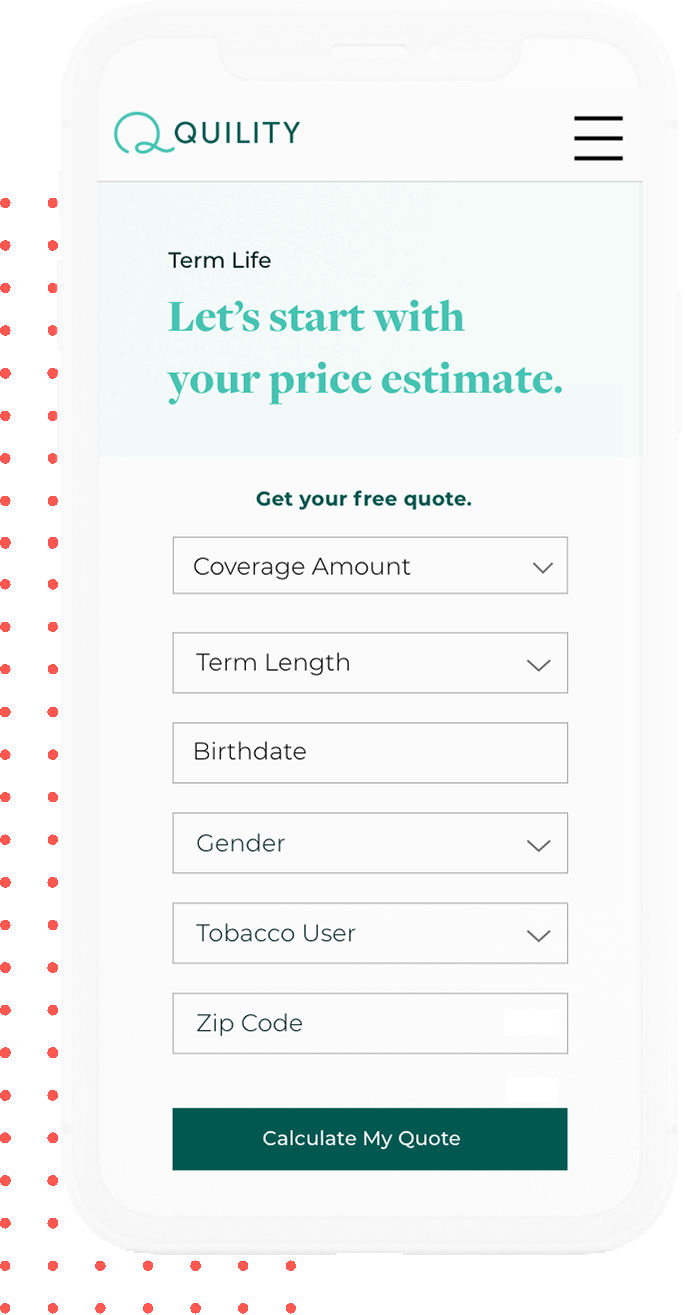

Ready to apply?

Get a free quote in seconds then continue to our online application. Your policy will be in your inbox in just a few simple steps!*

*For certain carriers

Term vs. Whole Life Insurance

If you’re in the market for life insurance, you may be torn between purchasing a temporary (term) or a permanent (whole or universal) life insurance policy.

TERM LIFE INSURANCE |

WHOLE LIFE INSURANCE |

|

What is it? |

“Renting” your coverage | “Owning” your coverage |

Length |

10, 15, 20, or 30-year term

|

Your whole life

|

Affordability |

Plans start at less than $18/month

|

More expensive |

Cash Value |

No | Yes |

Payment Flexibility |

None. If you miss a payment, your policy will terminate. |

More flexibility given the cash value component of your policy.

|

Return of Premium Rider |

Yes, an option. |

No, not an option.

|

| Term life insurance is right for me. |

I’m considering a permanent life insurance policy.

|

When should I buy term life insurance?

None of us can know when we’ll pass away or when our health situation may change for the worse. For the best rate, it makes sense to apply for term life insurance online today.

If I secure coverage 100% online, how do I receive my policy?

If approved, your policy details will be delivered via email.*

Do I qualify for term life insurance?

Most people who are in good health will qualify for coverage. However, you may still qualify for term life insurance even if you have an existing health condition, such as diabetes (though your premium may be higher).

How can I pay for my term life insurance policy?

You are able to pay for specific term life insurance policies monthly, quarterly, semi-annually or annually.

How much does term life insurance cost?

Term life insurance is generally the least expensive type of life insurance you can buy as it only covers a specified time frame. Rates can be less than $18/month.

How much life insurance coverage do I need?

Everyone has different insurance coverage needs. To help determine how much coverage is right for you and your family, visit our guide on life insurance coverage or connect with one of Quility’s insurance agents to ensure you are securing the right amount of coverage for your family.

How much life insurance coverage do I need?

Everyone has different insurance coverage needs. To help determine how much coverage is right for you and your family, visit our guide on life insurance coverage or connect with one of Quility’s insurance agents to ensure you are securing the right amount of coverage for your family.

Featured Articles

Let’s Get Started

Apply for term life insurance online or with support from our trusted agents today.